Audi Crooks: Unpacking the Scandal and Consumer Reactions

The Core of the Allegations: Manipulation and Misrepresentation

The Allegations of Manipulation

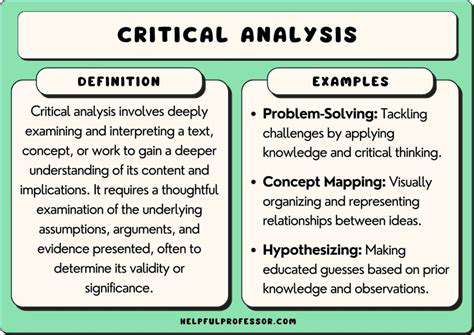

At the heart of these accusations lies the questionable handling of crucial financial data, resulting in substantial distortions in the organization's reported earnings. These alleged manipulations, should they be verified, would carry significant implications for investors and the broader financial system's credibility.

The precise techniques purportedly used remain under close examination, with initial reports pointing to a sophisticated network of accounting anomalies and potentially deceitful practices. Given the gravity of these claims, authorities are conducting their review with exceptional thoroughness and openness.

Evidence of Fabricated Data

Initial findings indicate that critical financial information may have been artificially altered to present an overly optimistic view of corporate performance. This allegedly manipulated data appears to have been employed to misguide investors and potentially secure favorable financial arrangements.

The suspected data falsification spans multiple fiscal periods, raising alarms about the scale of the deception and its potential ripple effects throughout the financial sector. A comprehensive investigation is required to fully uncover the extent of these alleged improprieties.

Motivations Behind the Manipulation

Investigators are currently exploring various potential motives for these alleged actions, ranging from personal enrichment of involved parties to efforts aimed at artificially sustaining the company's stock valuation.

Identifying the underlying motivations is essential for assessing the full impact of these alleged manipulations and ensuring appropriate consequences for those involved. Understanding what drove these decisions is crucial for preventing repetition of similar situations.

The Impact on Investors

The potential consequences for investors are severe. Those who made financial decisions based on the accuracy of the reported data may have incurred substantial losses due to the alleged misrepresentations.

Shareholders who purchased stock based on the questionable data may have legitimate grounds for legal recourse. The magnitude of these effects will become clearer as the investigation progresses and the full scope of the situation emerges.

Role of Internal Controls

The effectiveness of internal oversight mechanisms in preventing these alleged manipulations warrants careful examination. A thorough review of the company's control systems is necessary to understand how and why these safeguards failed to identify the questionable activities.

Deficiencies in internal controls might indicate systemic weaknesses requiring immediate attention to forestall future incidents. This inquiry will provide valuable insights into the adequacy of the company's oversight measures and their practical implementation.

Potential Legal Ramifications

The legal consequences stemming from these allegations could be substantial. Criminal indictments and civil litigation represent possible outcomes if the claims of manipulation are substantiated.

Individuals found responsible for the alleged misconduct could potentially face severe penalties, including substantial monetary fines and incarceration. The judicial process will proceed with meticulous attention to ensure fair treatment for all parties.

Repercussions for the Company's Reputation

The alleged misconduct has the potential to cause lasting harm to the organization's public standing. Confidence in the company's financial reporting has likely been significantly undermined, which could adversely affect future business operations and investor relations.

The long-term damage to the company's reputation may prove particularly challenging to repair, potentially impairing its ability to attract investment and maintain positive stakeholder relationships. The organization's future success will depend on its capacity to restore trust and demonstrate an authentic commitment to ethical business practices.

The Impact on Audi's Brand Image and Future Strategies

Audi's Brand Image: Tarnished or Resilient?

The recent developments surrounding Audi, sometimes referred to as the Audi controversy, have undoubtedly affected the brand's carefully constructed identity. For years, Audi has cultivated an image representing German engineering prowess, luxury, and refined design. This painstakingly developed reputation, built over decades of positive associations, now faces serious examination. Public perception remains critical; damage to the brand's image could significantly influence future sales and market position.

Customers, especially those prioritizing transparency and ethical business practices, may exhibit greater hesitancy in trusting Audi going forward. This shift in consumer sentiment could present substantial challenges, necessitating significant efforts to restore credibility.

The Financial Implications of the Scandals

Beyond reputational concerns, the Audi situation carries important financial consequences. Potential declines in sales, investor wariness, and possible legal outcomes could substantially impact the company's financial performance. The costs associated with addressing these issues, including public relations initiatives and potential legal settlements, are likely to be considerable.

Maintaining financial stability amidst these challenges will require prudent fiscal management and a steadfast commitment to resolving the underlying problems.

Consumer Trust and Loyalty: Erosion and Restoration

Consumer confidence represents a delicate asset, easily damaged and challenging to rebuild. The Audi revelations have clearly impacted consumer trust in the brand. Long-standing customers may reconsider their loyalty, with the possibility of customer attrition being significant.

Rebuilding consumer confidence will demand a comprehensive strategy incorporating transparent communication, demonstrable adherence to ethical standards, and sincere efforts to address stakeholder concerns.

Internal Investigations and Corporate Accountability

The breadth of internal reviews and the degree of corporate responsibility assumed will play pivotal roles in determining the lasting effects of the Audi situation. Prompt and exhaustive investigations, coupled with decisive corrective measures, are essential to demonstrate commitment to resolving the issues. This may include appropriate disciplinary actions against individuals involved in misconduct.

Adapting Future Strategies: A New Approach

Audi's strategic planning must evolve to accommodate the changed landscape. Moving forward, emphasis on transparent communication, robust ethical frameworks, and proactive measures to prevent recurrence of similar issues becomes paramount. This includes revisiting internal procedures and implementing external verification mechanisms.

The organization needs to demonstrate genuine dedication to ethical operations, not merely as a public relations strategy, but as a fundamental principle embedded within corporate culture.

Public Relations and Reputation Management

An effective public relations approach will prove essential in mitigating damage and rehabilitating the brand's image. This requires proactive and transparent communication, acknowledging the issues, outlining corrective measures, and actively engaging with all stakeholders.

The company must show authentic willingness to learn from these events and implement meaningful changes to prevent recurrence.

Strategic Partnerships and Industry Collaboration

Audi's relationships with partners, suppliers, and the broader automotive sector will be meaningfully affected. The company should cultivate stronger collaborative relationships founded on trust and mutual respect. Strategic alliances emphasizing ethical conduct and transparency could prove instrumental in rebuilding confidence.

Cooperation with regulatory authorities and industry groups to establish more rigorous standards and best practices could contribute to a more ethical and sustainable future for the automotive industry.

The Road Ahead: Potential Consequences and Lessons Learned

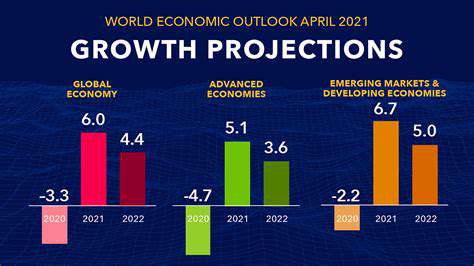

Navigating Uncertain Economic Tides

The global economic environment remains characterized by notable volatility, with fluctuating interest rates, inflationary pressures, and geopolitical uncertainties affecting multiple sectors. These factors create a complex operating environment for businesses and individuals, necessitating careful consideration and strategic adaptation. Recognizing and mitigating risks associated with these economic fluctuations proves essential for sustained success.

Economic downturns, while frequently challenging, can also create opportunities for innovation and restructuring. Organizations that proactively adjust to changing market conditions often emerge more robust and resilient long-term. This requires forward-looking risk management approaches and commitment to enduring value creation.

Technological Disruption and Innovation

Rapid technological advancements continue transforming industries at unprecedented rates. From artificial intelligence and automation to expanding Internet of Things applications, businesses must embrace these changes to maintain competitiveness. This demands emphasis on continuous learning and adaptation to new technologies and their workflow implications.

Technology integration into existing processes typically enhances efficiency and productivity. However, it also requires careful consideration of potential workforce impacts and the necessity for reskilling initiatives to address evolving employment requirements.

The Importance of Sustainable Practices

Environmental considerations increasingly influence corporate strategies, with consumers and investors demanding greater transparency and accountability regarding sustainability efforts. Companies prioritizing environmental responsibility frequently gain competitive advantages by demonstrating commitment to sustainable development.

Implementing sustainable practices can involve diverse initiatives, ranging from reducing carbon emissions and optimizing resource utilization to promoting ethical procurement and responsible waste handling.

Adapting to Shifting Consumer Demands

Consumer preferences and behaviors continue evolving, influenced by factors including increased information access, changing social values, and lifestyle transformations. Businesses must adapt to these changes and comprehend their target demographics' motivations and expectations.

Understanding evolving customer needs and desires proves critical for developing effective marketing approaches and creating products and services that align with market trends. Organizations failing to adapt risk losing market position to competitors better attuned to current developments.

The Role of Global Collaboration

In our increasingly interconnected world, international cooperation becomes essential for addressing complex challenges and fostering innovation. Businesses and governments must collaborate to develop solutions for global issues including climate change, economic inequality, and public health concerns.

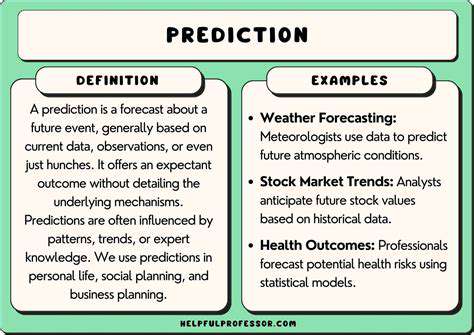

Managing Risk and Uncertainty

Predicting future developments remains inherently difficult, yet effective risk management strategies prove crucial for navigating coming challenges. Organizations must proactively identify and evaluate potential risks, developing contingency plans to minimize unexpected event impacts.

Proactive risk management can substantially reduce negative outcome likelihoods and enhance organizational resilience. This requires comprehensive understanding of both internal and external factors potentially affecting operations.

Investing in Human Capital

Developing a skilled and adaptable workforce remains crucial for achieving long-term success. This includes fostering continuous learning cultures, providing professional development opportunities, and ensuring employees possess necessary skills for future challenges.

Human capital investment represents not simply social responsibility, but strategic necessity for sustained growth and innovation. Empowering employees to adapt and learn proves fundamental for navigating evolving business landscapes.

Read more about Audi Crooks: Unpacking the Scandal and Consumer Reactions

Hot Recommendations

-

*Valladolid vs. Celta de Vigo: La Liga Clash – Tactical Preview & Predictions

-

*AJ Ferrari: Emerging Talent Profile & Career Highlights in [Your Sport]

-

*UCSD Women’s Basketball: Season Recap, Standout Performers & Future Outlook

-

*Real Madrid C.F. Femenino vs. Arsenal: Women’s Soccer Showdown Analysis

-

*Chet Holmgren: NBA Prospect Profile – Stats, Highlights & Future Projections

-

*RJ Davis: Rising Talent Profile, Career Highlights & Future Projections

-

*Kyle Busch: NASCAR Star’s Career Highlights, Race Wins & Future Prospects

-

*River Plate vs. Club Ciudad de Bolívar: Argentine Soccer Showdown Analysis

-

*Costco Membership: Benefits, Savings Tips & Latest Updates

-

*Pokémon Go: Latest Updates, Tips & Community Events