Dow Jones Stock Futures: Trends, Analysis & What Investors Should Know

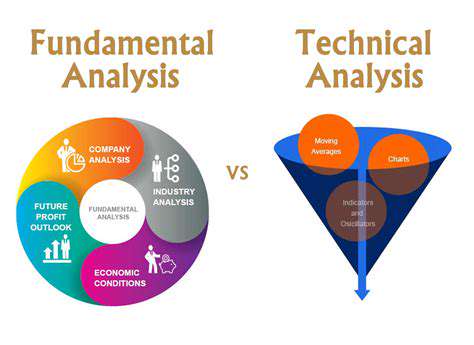

Analyzing Dow Jones Futures: Technical Indicators

Technical analysis of Dow Jones futures incorporates multiple analytical tools. Moving average convergence divergence (MACD) helps identify momentum shifts, while Bollinger Bands measure volatility extremes. Volume analysis provides critical confirmation of price movements, distinguishing meaningful trends from temporary fluctuations. Seasoned traders combine these indicators to develop probabilistic assessments of future price action.

Market Volatility and its Impact

Volatility regimes significantly influence trading strategy effectiveness. Mean-reversion strategies often outperform during high-volatility periods, while trend-following approaches excel in sustained directional markets. The VIX index serves as a valuable sentiment gauge, though its predictive power varies across market cycles.

Economic Data Releases and Their Influence

Scheduled economic reports create predictable volatility spikes in futures markets. Nonfarm payrolls and CPI releases frequently trigger substantial price movements. Astute traders analyze historical market reactions to specific data points, recognizing that surprise components often matter more than absolute values.

Sentiment Analysis and its Role

Market sentiment indicators range from put/call ratios to news analytics. Extreme sentiment readings frequently precede trend reversals, creating opportunities for contrarian traders. Social media platforms have emerged as additional sentiment data sources, though their noise-to-signal ratio remains high.

Geopolitical Events and Their Implications

Unpredictable geopolitical developments require flexible trading frameworks. Risk-off episodes typically see flight-to-quality movements into defensive sectors. Traders monitor sovereign credit spreads and currency markets for early warning signs of shifting risk appetites.

Key Support and Resistance Levels

Price memory creates psychological levels that influence future trading activity. Round numbers often attract concentrated order flow, while previous swing highs/lows establish natural reference points. Volume profile analysis helps identify truly significant price levels versus temporary congestion zones.

Identifying Trend Reversals

Reliable trend reversal signals combine multiple confirmation factors. Divergences between price and momentum indicators often precede trend changes. Successful traders wait for cluster signals rather than relying on single indicators, reducing false signals. Market breadth measures provide additional confirmation when assessing potential trend sustainability.

Read more about Dow Jones Stock Futures: Trends, Analysis & What Investors Should Know

Hot Recommendations

-

*Valladolid vs. Celta de Vigo: La Liga Clash – Tactical Preview & Predictions

-

*AJ Ferrari: Emerging Talent Profile & Career Highlights in [Your Sport]

-

*UCSD Women’s Basketball: Season Recap, Standout Performers & Future Outlook

-

*Real Madrid C.F. Femenino vs. Arsenal: Women’s Soccer Showdown Analysis

-

*Chet Holmgren: NBA Prospect Profile – Stats, Highlights & Future Projections

-

*RJ Davis: Rising Talent Profile, Career Highlights & Future Projections

-

*Kyle Busch: NASCAR Star’s Career Highlights, Race Wins & Future Prospects

-

*River Plate vs. Club Ciudad de Bolívar: Argentine Soccer Showdown Analysis

-

*Costco Membership: Benefits, Savings Tips & Latest Updates

-

*Pokémon Go: Latest Updates, Tips & Community Events