QBTS Stock: Market Trends, Financial Performance & Future Projections

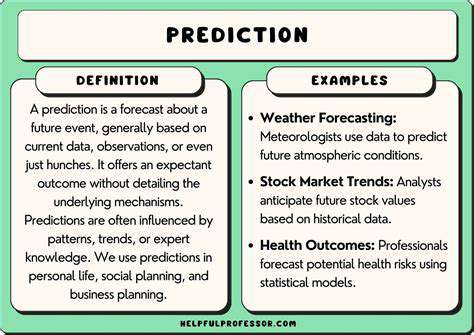

Artificial intelligence (AI) is rapidly transforming various sectors, and a key component of this transformation is the ability to predict future outcomes. This capability relies on sophisticated algorithms and vast datasets, allowing machines to identify patterns and trends that would be difficult or impossible for humans to discern. Understanding the fundamental principles behind AI prediction is crucial for harnessing its potential and mitigating potential risks. AI prediction models often involve complex mathematical calculations and statistical analyses, enabling them to extrapolate from existing data and make informed estimations about future events.

Future Projections and Investment Considerations

Market Trends

The global market is experiencing significant shifts, driven by technological advancements and evolving consumer preferences. These shifts are creating new opportunities and challenges for investors. Understanding these trends is crucial for making informed investment decisions. Rapid technological advancements, particularly in artificial intelligence and automation, are transforming industries and reshaping business models. This necessitates a proactive approach to investment strategies, focusing on sectors poised for growth.

Consumer preferences are also evolving, with a growing emphasis on sustainability, ethical sourcing, and personalized experiences. Companies that adapt to these trends will likely enjoy a competitive advantage. This necessitates a deep dive into industry analysis and identifying companies with robust sustainability practices.

Investment Strategies

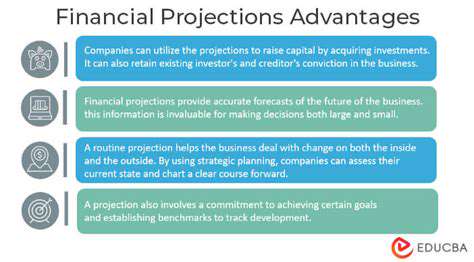

Diversification is a cornerstone of sound investment strategies. Spreading investments across various asset classes can help mitigate risks and potentially maximize returns. This approach involves considering a range of options, from stocks and bonds to real estate and alternative investments. Careful analysis of each asset class is necessary to determine the appropriate allocation within an investment portfolio.

Long-term investment horizons are often more advantageous than short-term ones. This allows for the accumulation of capital over time and the potential for higher returns, particularly in the context of market fluctuations. Patience and a well-defined investment plan are key to success in the long run.

Economic Outlook

The global economy is expected to experience moderate growth in the coming years. Factors such as ongoing geopolitical events, supply chain disruptions, and inflation will likely influence the pace and trajectory of this growth. Economic forecasts are complex, requiring analysis of various interconnected variables.

Inflationary pressures are anticipated to persist. This necessitates a nuanced approach to investment, factoring in the potential impact on different asset classes. Investors should consider inflation-hedging strategies to protect the purchasing power of their investments.

Technological Advancements

Technological advancements are revolutionizing various sectors, from healthcare and energy to manufacturing and finance. Investing in companies at the forefront of these innovations can yield significant returns. This requires staying informed about emerging technologies and identifying the companies poised to capitalize on these developments.

The integration of technology across industries is reshaping the competitive landscape. This necessitates constant vigilance and adaptation by investors and businesses alike. Companies that embrace and successfully implement these innovations will be better positioned to thrive in the future.

Sustainable Investments

The importance of environmental, social, and governance (ESG) factors is growing. Investors are increasingly seeking opportunities that align with their values and contribute to a more sustainable future. This trend is driven by a growing awareness of the interconnectedness between environmental concerns, social well-being, and corporate governance.

Risk Management

Investment decisions are inherently associated with risk. Understanding and managing these risks is crucial for the success of any investment strategy. Market fluctuations, geopolitical uncertainties, and economic downturns are all potential risks that investors should acknowledge and address in their portfolio management.

Thorough due diligence and diversification are essential tools for managing investment risks. A comprehensive understanding of the market and the potential risks is necessary to make informed and appropriate decisions.

Read more about QBTS Stock: Market Trends, Financial Performance & Future Projections

Hot Recommendations

-

*King Charles III: Royal Legacy, Duties & Modern Challenges

-

*Jennifer Tilly: Hollywood Career, Iconic Roles & Latest Updates

-

*F1 Sprint Race Explained: Format, Tips & Championship Impact

-

*Jay Bilas Bracket: College Basketball Insights and Expert Predictions

-

*New Mexico Travel Guide: Top Destinations, Culture & Hidden Gems

-

*Steve Harvey: Comedian, Talk Show Icon & Latest Ventures

-

*Jerome Baker: NFL Profile, Career Stats & Future Potential

-

*Dallas Stars: NHL Team Profile, Season Recap & Future Projections

-

*When Is the NFL Draft? Complete Guide to Dates, Teams & Insider Analysis

-

*Kyle Gibson: MLB Pitching Spotlight – Stats, Career Recap & Recent Performances