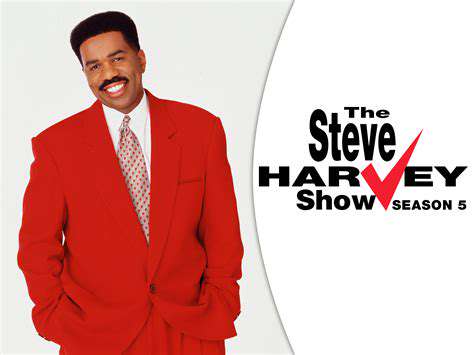

Steve Harvey: Comedian, Talk Show Icon & Latest Ventures

Recent Ventures and Future Prospects

Recent Developments in Venture Capital

The recent surge in venture capital investments has been driven by a confluence of factors, including increased investor confidence and a robust economy. Several prominent venture capital firms have made significant investments in innovative startups, further highlighting the sector's growing importance. These investments are often strategically aligned with the firms' long-term investment objectives and market analysis. This activity is indicative of a positive outlook for future growth opportunities.

The current environment shows a strong interest in emerging technologies, particularly those related to artificial intelligence and sustainable solutions. This focus reflects a global shift towards innovation and a desire to address pressing societal challenges. Investors are prioritizing ventures that demonstrate clear market potential and a strong team.

Emerging Technologies and Innovation

Significant advancements in artificial intelligence (AI) are driving innovation across various sectors, from healthcare to finance. These advancements are creating new possibilities for automation, personalized experiences, and problem-solving. This rapid evolution necessitates a keen understanding of the potential applications and risks associated with these technologies.

Sustainable technologies are also gaining momentum, with investments flowing into renewable energy, sustainable agriculture, and circular economy models. This growing interest reflects a global commitment to environmental sustainability and the need for innovative solutions to climate change. These ventures are critical for the future.

Global Market Trends and Opportunities

The global market presents dynamic opportunities, with emerging economies experiencing rapid growth and offering unique investment prospects. Understanding these trends and adapting investment strategies to these emerging markets is crucial for success. Analyzing the specific nuances of each market and its regulatory environment is paramount for navigating these complexities.

International collaborations are becoming increasingly important for leveraging expertise and resources, fostering innovation, and expanding market reach. This interconnectedness is creating new avenues for investment and growth, particularly for businesses targeting global markets.

Financial Strategies and Portfolio Management

Effective portfolio management strategies are essential for maximizing returns and mitigating risk in the face of market volatility. Diversification across different sectors and geographies is crucial for building resilient portfolios that can withstand market fluctuations. Understanding the specific risks and rewards associated with each investment is vital for prudent management.

Thorough due diligence and robust risk assessment processes are crucial for identifying potential challenges and mitigating risks before substantial investment commitments are made. Effective due diligence processes and risk management strategies play a critical role in the success of venture capital investments.

Regulatory Landscape and Compliance

Navigating the complex regulatory landscape is crucial for venture capital firms to ensure compliance and maintain investor confidence. Understanding and adapting to evolving regulations is essential for long-term success. This includes keeping abreast of legislative changes and industry best practices.

Maintaining transparency and accountability in financial reporting and operations is essential for building trust and maintaining investor relationships. This commitment to transparency is paramount in the venture capital industry.

Challenges and Considerations for Future Investments

The venture capital landscape is not without its challenges, including economic downturns and evolving market dynamics. Adaptability and flexibility are crucial for navigating these complexities and maintaining a long-term perspective. Future investments must account for these external factors.

Competition for talent and capital is intense. Identifying and attracting top talent is vital for driving innovation and success in the sector. Building strong, collaborative relationships with entrepreneurs is critical for long-term success. This is essential to navigate the evolving landscape.

Read more about Steve Harvey: Comedian, Talk Show Icon & Latest Ventures

Hot Recommendations

-

*Valladolid vs. Celta de Vigo: La Liga Clash – Tactical Preview & Predictions

-

*AJ Ferrari: Emerging Talent Profile & Career Highlights in [Your Sport]

-

*UCSD Women’s Basketball: Season Recap, Standout Performers & Future Outlook

-

*Real Madrid C.F. Femenino vs. Arsenal: Women’s Soccer Showdown Analysis

-

*Chet Holmgren: NBA Prospect Profile – Stats, Highlights & Future Projections

-

*RJ Davis: Rising Talent Profile, Career Highlights & Future Projections

-

*Kyle Busch: NASCAR Star’s Career Highlights, Race Wins & Future Prospects

-

*River Plate vs. Club Ciudad de Bolívar: Argentine Soccer Showdown Analysis

-

*Costco Membership: Benefits, Savings Tips & Latest Updates

-

*Pokémon Go: Latest Updates, Tips & Community Events