Dow Jones Stock Markets Futures: What Investors Need to Know Today

List of Contents

Futures contracts are agreements to buy or sell assets at predetermined prices.

Dow Jones Futures predict market trends before official openings.

Economic indicators significantly impact Dow Jones Futures trading.

Investors use Dow Futures to hedge against potential equity losses.

Risks exist in trading due to market volatility and misjudgments.

Staying informed about economic reports aids effective trading strategies.

Market sentiment influences investor behavior and futures movement.

Geopolitical events can create volatility in Dow Jones Futures.

Innovation in technology sectors can positively affect Dow Futures outlook.

Various sectors may react differently to economic conditions affecting investors.

What Are Dow Jones Futures?

Understanding Futures Contracts

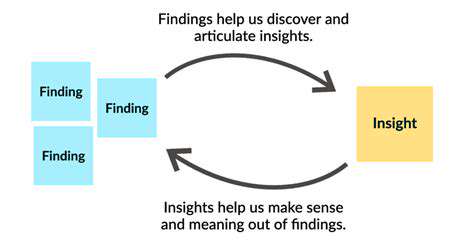

Futures Contracts are binding agreements where two parties commit to buying or selling specific assets at fixed prices on future dates. Traders use these to manage risk or bet on price shifts. For the Dow Jones, futures let investors gauge the index’s likely direction pre-market, letting them position themselves ahead of broader trends.

A critical feature of futures is leverage, enabling control of large positions with minimal capital. But this amplifies both profits and losses. Grasping leverage mechanics and market unpredictability is non-negotiable for futures participants.

The Role of Dow Jones Futures in Market Forecasting

Dow Jones Futures act as a barometer for investor sentiment, often foreshadowing market openings. Rising futures typically signal optimism about economic data or corporate results, while declines hint at caution. This predictive value makes them vital for traders and institutions.

For example, when a major tech firm outperforms earnings estimates, futures may spike, prompting rapid strategy adjustments. Pre-market reports—like employment figures—often trigger these shifts, making real-time updates indispensable.

Factors Influencing Dow Jones Futures

Key drivers include economic data, interest rates, and global events. Metrics like GDP growth or unemployment rates reflect economic health: strong jobs data lifts futures, while weak numbers drag them down. Interest rates are equally pivotal—higher rates can stifle growth stocks dominating the Dow.

Geopolitical shocks, from trade wars to military conflicts, spark abrupt futures swings as traders digest news. Sentiment also plays a role: fear or euphoria can override fundamentals, underscoring the market’s inherent volatility.

How Investors Use Dow Jones Futures for Hedging

Hedging with futures helps cushion equity losses. If stocks are poised to drop, shorting Dow Futures can offset declines. This tactic gains urgency during economic uncertainty when downturns loom.

Successful hedging demands sharp analysis of market signals. Traders must time entries and exits precisely, balancing technical indicators with macroeconomic trends. Without this rigor, even well-intentioned hedges can backfire.

The Pitfalls of Trading Dow Jones Futures

Futures trading isn’t for the faint-hearted. Newcomers often stumble over margin calls, contract complexities, and wild price swings. Poor risk management can erase capital swiftly. Discipline and continuous learning are mandatory.

Overreliance on algorithms worsens losses during turbulence. Emotional decisions—like panic selling—undermine strategies. Blending data-driven analysis with psychological awareness creates a more resilient approach.

Conclusion: Practical Strategies for Futures Trading

To trade Dow Futures effectively, marry economic awareness with technical skill. Track indicators like CPI reports and Fed statements, and dissect earnings of index heavyweights. Experts advocate mixing chart patterns with fundamental checks.

Maintaining a trading journal helps spot behavioral patterns and refine tactics. Adaptability is key—markets evolve, and so must strategies. While mastery takes time, the rewards justify the effort for committed traders.

Current Trends Influencing Dow Jones Futures

Economic Indicators and Their Impact

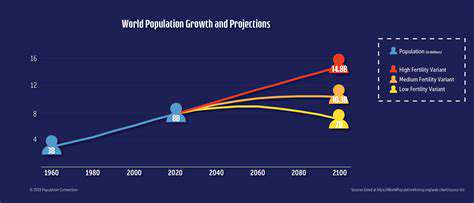

Recent retail sales jumped 0.6% in August, defying inflation concerns. Such surprises reshape forecasts for Dow components. Meanwhile, unemployment lingers near 3.5%, hinting at wage growth and consumer spending resilience. These metrics guide futures positioning.

Monetary Policy Adjustments

The Fed’s decision to hold rates at 5.25% offers temporary stability. But with inflation stubbornly high, future hikes could dampen enthusiasm for rate-sensitive sectors. Monitoring Fed rhetoric is now a trader’s daily ritual.

Geopolitical Events and Their Repercussions

U.S.-China trade talks and Eastern European tensions keep markets on edge. Tariffs and energy supply risks ripple through sectors like tech and industrials. Savvy investors diversify into defensive stocks to buffer against shocks.

Technological Developments and Innovation

AI breakthroughs at firms like Apple and Microsoft fuel optimism. As legacy industries adopt automation, Dow Futures may rally. But tech’s dominance also raises valuation concerns—balance is essential.

Market Sentiment and Investor Behavior

Bullish sentiment recently dipped to 28%, reflecting caution. Behavioral cues, like panic selling, can amplify downturns. Staying calm amid noise separates seasoned traders from novices.

Analysis of Global Events Affecting the Dow

Current Economic Indicators and Their Impact on the Dow

CPI’s 4.2% annual rise keeps inflation in focus. The Fed’s rate pause offers relief, but traders watch for policy shifts. Sectors like utilities often thrive in high-rate climates.

Geopolitical Tensions: Risks and Responses

Trade disputes and regional conflicts inject volatility. Diversification into defense stocks hedges against unpredictability. Proactive portfolio tweaks mitigate downside risks.

Corporate Earnings Reports and Forecasts

With S&P 500 earnings up 8%, optimism lingers. But tech giants’ forecasts could make or break sentiment. Scrutinizing guidance is as vital as reviewing past performance.

Inflationary Pressures and the Fed's Monetary Policy

Inflation remains a key concern. The Fed’s next move hinges on PPI and wage trends. Anticipating policy changes lets traders pivot early.

Sector Performance and Investment Opportunities

Energy and consumer staples shine amid uncertainty. Tech faces rate-related headwinds, pushing investors toward stable sectors. Flexibility in allocation is critical.

Global Markets and Their Interrelationships

European central bank policies and Asian demand shifts sway the Dow. Oil price surges hit transport stocks, while dollar swings alter export dynamics. A global lens sharpens local strategies.

Strategies for Trading Dow Jones Futures

Understanding Market Trends and Indicators

Understanding Market Trends requires blending moving averages with GDP data. Geopolitical alerts—like tariff announcements—demand real-time reactions. Earnings surprises in Dow stocks often dictate short-term plays.

Developing a Risk Management Strategy

Limit losses by capping each trade at 1-2% of capital. Stop-loss orders are non-negotiable. Diversify strategies—combine scalping with swing trades to balance risk exposure.

Utilizing Technology and Trading Platforms

Algorithmic tools execute trades at lightning speed, capitalizing on micro-trends. Real-time dashboards track Fed speeches and earnings calls. Mobile apps let traders act mid-commute—a must in today’s 24/7 markets.

Continuous Learning and Adaptation

Markets mutate constantly. Webinars, journals, and trader forums offer fresh tactics. Pairing historical data with emerging trends—like AI’s market impact—builds future-proof skills.

Read more about Dow Jones Stock Markets Futures: What Investors Need to Know Today

Hot Recommendations

-

*Damian Lillard: Clutch Moments and Career Highlights

-

*AC Milan: Team Evolution, Star Players, and Future Prospects

-

*India vs. Maldives: Analyzing the Unlikely Sports Rivalry

-

*Lightning vs. Stars: NHL Game Recap and Performance Analysis

-

*Stephen Collins: Career Retrospective and Impact on Television

-

*Tennessee Women’s Basketball: Season Overview & Rising Star Profiles

-

*Tobin Anderson: Rising Star Profile and College Basketball Insights

-

*Lucas Patrick: From Court Vision to Clutch Plays – A Deep Dive

-

*Devils vs. Penguins: NHL Face Off – Game Recap and Highlights

-

*Skye Nicolson: Rising Talent Profile and Career Highlights