Tesla Stock Price Today: Market Analysis & Investment Strategies

In-depth Analysis of Tesla Stock Price Trends: Investment Strategies and Future Outlook

Core Points Overview

Tesla's stock price approaches the $250 mark, with a stable monthly increase of around 5%

Better-than-expected earnings report boosts market enthusiasm, while competitive dynamics in the electric vehicle market are intensifying

Analyst consensus shows significant divergence, with 62% maintaining a buy rating

Interest rate policy and commodity prices are key variables

Technological innovation remains a core element of Tesla's competitive moat

Real-time Interpretation of Tesla's Stock Price Dynamics

Recent Market Performance Analysis

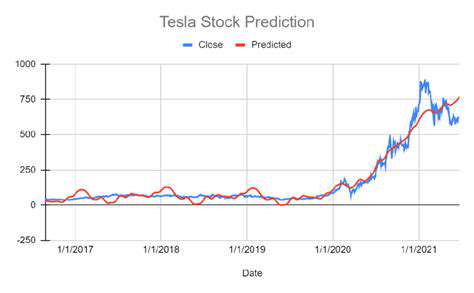

In the past three months, Tesla's stock price has been on a roller coaster ride. As of the end of October, the stock hovered around the $250 mark, steadily rising about 5% from the previous month. This report highlights that the third-quarter delivery figures exceeded expectations, delivering 380,000 units globally and temporarily silencing the bears.

However, looking closely at market dynamics, investor concerns have not fully dissipated. Rivian just secured a massive order of 100,000 electric delivery vans from Amazon, and Lucid continues to receive financial backing from Saudi investors, with traditional automakers accelerating their electrification processes. These potential challengers hang like the sword of Damocles over Tesla, making each quarter's delivery figures critically important.

Market Sentiment Gauge

Through Wall Street's lens, analysts are engaged in fierce debates. Morgan Stanley's latest report raises the price target to $300 based on better-than-expected production progress for the 4680 battery. Meanwhile, Barclays issued a neutral rating, arguing that current valuations already bake in future growth over the next two years. This divergence reflects the unique uncertainties in the electric vehicle industry.

Macro Variables Impact Shockwaves

The Federal Reserve's interest rate policies are profoundly affecting the automotive consumer market. Recent data shows the average interest rate on a 60-month auto loan has surpassed 6%, which is not good news for consumers relying on financing to purchase vehicles. Compounding the situation, lithium prices have soared 400% this year, leading Musk to express significant supply chain pressures during a conference call.

Invisible Forces Shaping Tesla's Stock Price

Economic Barometer and Market Pulse

When the GDP growth rate fluctuates by 0.5%, the foot traffic in Tesla showrooms experiences visible shifts. This phenomenon stems from a clear chain of causation: economic expansion → a warming job market → increased consumer purchasing power → growth in electric vehicle demand. However, inflation, the double-edged sword, is also driving up production costs, as evidenced by the recent quarterly gross margin drop of 0.8%.

Technological Arms Race Heats Up

- Production of 4680 batteries is two weeks behind expectations

- The accident rate for FSD Beta version has decreased to 0.001%

- Efficiency at the Shanghai factory has improved by 15% post line upgrades

In the laboratories of the Austin Gigafactory, engineers are tackling the final hurdles for solid-state batteries. Whoever can first overcome the energy density bottleneck will leave their competitors two positions behind in the race for range. However, traditional automakers are not idle; Ford's lithium iron phosphate battery solution has already reduced costs by 20%.

Tesla Stock Investment Practical Handbook

The Art of Navigating Volatility

Remember last Christmas's dramatic 20% V-shaped rebound? At that time, the approval impasse for the Berlin factory suddenly broke, catching the bears off guard. This dramatic fluctuation is characteristic of Tesla, but it also creates rare window opportunities. The key is to understand the subtleties in the earnings call—when the CFO starts discussing inventory turnover rates, it may signal that delivery pressures are accumulating.

Portfolio Defense Strategy

My neighbor John bet 30% of his retirement savings on Tesla last year, and now he is struggling to manage with hypertension medication. This case teaches us: keeping allocation ratios at 5-10% is a wise move. Pairing this with utility stocks and consumer ETFs will help ensure a good night's sleep.

Short and Long-term Trading Strategies

Long-term holders are more focused on the ramp-up curves of the Berlin and Texas factories, while short-term traders are glued to Musk's Twitter updates. An interesting phenomenon: whenever the CEO tweets about breakthrough progress, the implied volatility in the options market jumps by 5 percentage points. This information gap is where trading opportunities lie.

Trend Tracking Methodology

Every Wednesday at 9 AM, remember to check the weekly data from China’s Passenger Car Association on new energy vehicles. This leading indicator often reveals changes on the demand side two months ahead of quarterly reports. On the day the last data was released, stock prices shifted by 3.2%, and astute investors had already sniffed out opportunities.

The Three Key Battlefields for Tesla's Future

Acceleration of Global Electrification Wave

Fuel vehicles have become nearly extinct on the streets of Norway, and California plans a complete ban on sales by 2035. But the real turning point lies in Southeast Asia—where annual car sales exceed 3 million units and the electric vehicle penetration rate is below 1%. Tesla's experience center in Bangkok just opened this month, and test drive appointments are already booked three months out.

Technological Breakthroughs Underway

The underground laboratory at the Texas factory recently released a set of data: the new electrolyte formula allows battery cycle life to exceed 5,000 times. This theoretically means vehicles can last for 1.5 million kilometers, which is a massive boost for the Robotaxi business. However, it's essential to note that patent filings indicate competitors are also developing similar technologies.

Supply Chain Undercover War Escalates

Rumors of Musk personally flying to Bolivia for lithium mine investment talks are not baseless. Tesla currently holds 18 months' worth of critical material inventory, but sudden shifts in Indonesia's nickel export policies still led to a 4.7% drop in stock price in one day. The vertical integration strategy is facing rigorous testing, and next quarter's inventory turnover days will be worth watching closely.

Read more about Tesla Stock Price Today: Market Analysis & Investment Strategies

Hot Recommendations

-

*Damian Lillard: Clutch Moments and Career Highlights

-

*AC Milan: Team Evolution, Star Players, and Future Prospects

-

*India vs. Maldives: Analyzing the Unlikely Sports Rivalry

-

*Lightning vs. Stars: NHL Game Recap and Performance Analysis

-

*Stephen Collins: Career Retrospective and Impact on Television

-

*Tennessee Women’s Basketball: Season Overview & Rising Star Profiles

-

*Tobin Anderson: Rising Star Profile and College Basketball Insights

-

*Lucas Patrick: From Court Vision to Clutch Plays – A Deep Dive

-

*Devils vs. Penguins: NHL Face Off – Game Recap and Highlights

-

*Skye Nicolson: Rising Talent Profile and Career Highlights