Dólar TL Update: Currency Trends and Economic Insights

International Economic Influences and Global Market Sentiment

Global Economic Uncertainty and its Impact

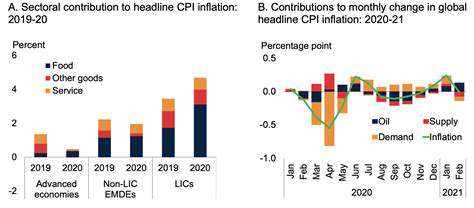

The world economy today faces a tangled web of challenges—soaring prices, geopolitical strife, and fractured supply chains. These intertwined issues breed deep uncertainty for companies and investors globally. Swinging interest rates, shifting currencies, and unpredictable commodity prices fuel market volatility. Such instability complicates long-term planning, particularly for firms with cross-border operations.

Every industry feels these tremors—from factories and tech firms to energy producers and financial institutions. Businesses walk a tightrope, juggling production expenses, supply chain durability, and customer needs while weathering these international economic storms.

The Role of Monetary Policy in Shaping Markets

Central banks hold tremendous power over market moods through interest rate decisions. When giants like the Federal Reserve adjust rates, the effects ripple through currency values, loan costs, and investor psychology. These moves can tilt the scales for stocks, bonds, and property values, keeping markets in constant motion.

Geopolitical Tensions and Market Volatility

World events—trade wars, political upheavals, or armed conflicts—send shockwaves through financial markets. Investors scramble to assess risks and opportunities, causing wild swings in stock values, currency exchange rates, and raw material costs. Markets detest uncertainty, and these events deliver it in spades.

The Influence of Commodity Prices on Global Markets

When oil, gold, or wheat prices bounce, entire economies feel the jolt. These fluctuations alter production expenses, inflation levels, and what consumers can afford. Take oil—its price changes directly hit transportation costs and energy bills, sending ripples through industries and household budgets alike.

The Importance of Currency Exchange Rates

Exchange rates make or break international business. A strong home currency prices exports out of markets, while a weak one makes imports painfully expensive—potentially sparking inflation. Smart companies treat currency risk management as essential armor for global operations.

The Impact of Supply Chain Disruptions

Broken supply chains—whether from natural disasters, political chaos, or pandemics—hammer global commerce. The results? Empty shelves, ballooning production costs, and nervous consumers. Businesses now prioritize building supply chain toughness to weather these disruptions.

Investor Sentiment and Market Predictions

Market moods move mountains. When optimism reigns, money flows and prices climb. When fear takes over, markets tumble. Seasoned investors watch sentiment indicators like hawks—survey data, news tone, market whispers—to steer their strategies. This collective psychology often dictates where markets head next.

Expert Insights and Market Predictions

Expert Predictions for Q3 2024

Analysts spot changing tides in consumer behavior for Q3 2024. Warning lights flash for slowing growth, especially in technology sectors, as rising borrowing costs and global uncertainty take their toll. Yet some industries buck the trend—healthcare keeps steady thanks to aging populations and medical breakthroughs, while green energy draws increasing investment amid global climate commitments.

Analyzing the Macroeconomic Landscape

The global economic puzzle grows more complex. Inflation still bites, forcing central banks to act, while geopolitical flare-ups keep markets on edge. For businesses planning their next moves, seeing how these pieces connect could mean the difference between thriving and merely surviving.

Impact on Specific Industry Sectors

The tech slowdown won't hit equally—consumer-focused firms may stumble while business service providers hold firmer. Energy markets face their own reckoning as renewables advance, though policy shifts could accelerate or brake this transition. Each sector demands its own playbook for the quarters ahead.

Market Volatility and Risk Management

In these turbulent times, smart investors build shock absorbers. Spreading bets across industries and asset types softens the blows when markets convulse. The sharpest players combine deep research with flexibility—ready to pivot as new opportunities emerge or threats materialize. For Q3 2024, adaptability may prove the most valuable currency of all.

Read more about Dólar TL Update: Currency Trends and Economic Insights

Hot Recommendations

-

*Valladolid vs. Celta de Vigo: La Liga Clash – Tactical Preview & Predictions

-

*AJ Ferrari: Emerging Talent Profile & Career Highlights in [Your Sport]

-

*UCSD Women’s Basketball: Season Recap, Standout Performers & Future Outlook

-

*Real Madrid C.F. Femenino vs. Arsenal: Women’s Soccer Showdown Analysis

-

*Chet Holmgren: NBA Prospect Profile – Stats, Highlights & Future Projections

-

*RJ Davis: Rising Talent Profile, Career Highlights & Future Projections

-

*Kyle Busch: NASCAR Star’s Career Highlights, Race Wins & Future Prospects

-

*River Plate vs. Club Ciudad de Bolívar: Argentine Soccer Showdown Analysis

-

*Costco Membership: Benefits, Savings Tips & Latest Updates

-

*Pokémon Go: Latest Updates, Tips & Community Events

![Jase Richardson: Rising Star Profile & Impact in [Your Sport]](/static/images/18/2025-05/BeyondtheField2FCourt3APersonalQualitiesandCommunityInvolvement.jpg)